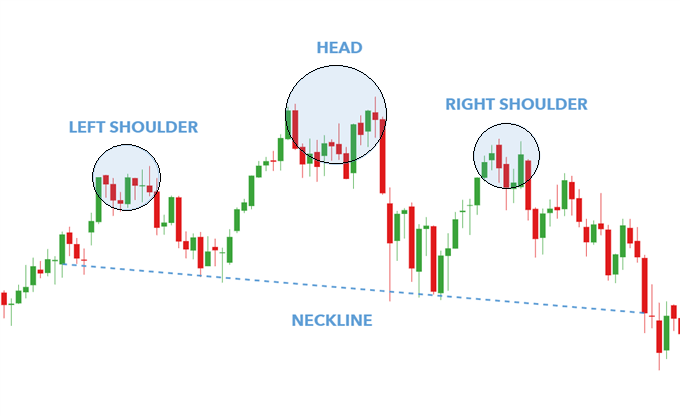

Head and Shoulder Pattern is a reversal structure that appears mainly in the upward trend or the upward momentum.

The price falls to a level where the selling price falls and the price takes support at a lower level which we call the Neckline.

The price improves by taking back neckline support before improvement which forms the Left shoulder.

The buying starts back at the neckline which goes to the next high and creates a new high price which we call the Head. The sell-off reduces the price and takes support on the neckline.

If the purchase is seen back on the neckline, the price goes up but it cannot reach the next high and goes back down. When it becomes the bottom top, we call that figure Right shoulder.

The difference is that this time the price does not fall and support the neckline but breaks the neckline more which indicates the breakout seen in this structure.

Volume is very important in this structure. The volume is higher when the left shoulder is formed. When the head is formed, the volume decreases. Which indicates weakness.

As the right shoulder is formed, the volume decreases further. This shows that the grip of the uptrend is no longer strong.

When the posterior neckline breaks, the increasing volume appears to decrease along with it.

Thank You...

Comments

Post a Comment